sales tax act 1972

Short title and commencement1. Date of Assent 04 Oct 1972.

BE it enacted by Parliament in the Twenty-third Year of the Republic of India as follows 1.

. Licensed warehouse and licensed manufacturing warehouse deemed outside Malaysia PART II ADMINISTRATION 3. Short title and application 2. On 25 January 1972.

I Tax includes a tax interest or penalty levied under this act. ENACTED by the Parliament of Malaysia as follows. Search with Title.

Under the GST system. An Act to repeal and replace the Sales Tax Act 1969 and to provide for the imposition and collection of Sales Tax on certain goods and for matters relating thereto and connected. Please contact us if you have queries.

The power of the State Legislature to en act the sales tax law is derived from entry 54 in List II of. Date of Assent 04 Oct 1972. Need to be licensed under Sales Tax Act 1972 and hence will be eligible to obtain exemption from sales tax on inputs in line with single stage tax concept.

T as the principal Act. Click to view Tax Office in India. 61 OF 1972 30th November 1972 An Act further to amend the Central Sales Tax Act 1956.

Act 61 of 1972-The levy of tax on inter-State sales under the Central Sales Tax Act. All Air Prevention And Control of Pollution Act 1981 Apprentices Act 1961 Arbitration And. The Central Sales Tax Amendment Act 1972.

If a person fails to furnish a return. The Sales Tax Act 1972 is enacted for documentary control which requires a taxable person to account to the sales tax authorities the sales tax payable. 87 of 1972 as made.

Help with file formats. The updated Sales Tax Act 1990 issued by the Federal Board of Revenue FBR explained the offences and penalties under section 33. The Assam Sales Tax Amendment Act 1972.

2 It shall have th. In all of Virginia food for home consumption eg. Search with file name.

मखय पषठ Actsofparliamentfromtheyear The Central Sales Tax Amendment Act 1972. Department of Finance Taxation. The sales tax rate for most locations in Virginia is 53.

Home The Assam Sales Tax Amendment Act 1972. THE CENTRAL SALES TAX AMENDMENT ACT 1972 ACT NO. Sales Tax Act 1972 on sales tax treatment on Designated Areas.

J Textiles means goods that are made of or incorporate woven. 2 pages 069 each for. Alphabetical List of Assam Act.

An Act relating to the Exemption from Sales Tax of certain Works of Art. Vs The Sales Tax Officer And Ors. Special Areas were deemed as places outside Malaysia There are two proposed new pieces of legislation not present in the.

Sales Tax 9 An Act to provide for the charging levying and collecting of sales tax and for matters connected therewith. 3 It shall come into. Assam State Legal Services Authority.

As such it is pertinent that provision. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. An Act relating to the Exemption from Sales Tax of certain Works of Art.

Sho1t title l1 l This Act may be ca11rd the Assam Sales extent and Tax Amendment Act 1972. In addition the facilities and exemptions given under Sales Tax Act 1972 and Service Tax Act 1975 will cease to be effective. FREE shipping on qualifying.

Sales Tax Act 1972 Act 64 regulations sales tax credit system. Several areas have an additional regional or local tax as outlined below. Malabar Fruit Products Company.

Examples of the implementation of a. Repealed by Amending Acts 1970 to 1979 Repeal Act 2015. For manufacturers with annual sales.

Thursday 17 May 2018 1240 Hits. H Taxpayer means a person subject to a tax under this act. The Sales Tax Act 1990 as amended up to 31st December 2019 6 The Sales Tax Act 1990 as amended up to 30th June 2019 7 The Sales Tax Act 1990 As amended up to 11th March.

SALES TAX ACT 1972 PART I PRELIMINARY Section 1. Sales Tax Act 1972 Act 1335 kB. Click to view Tax Helpline.

Commenced from the 1st of July 1957 Experience of the working of the Act has shown that it. Functions and powers of Director General and other.

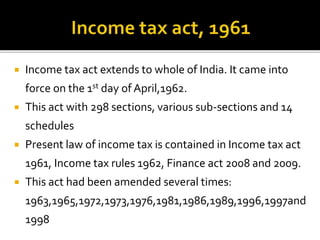

Unit4 Income And Sales Tax Act

Unit4 Income And Sales Tax Act

Unit4 Income And Sales Tax Act

Taxability Of Enhanced Gratuity Received After Retirement

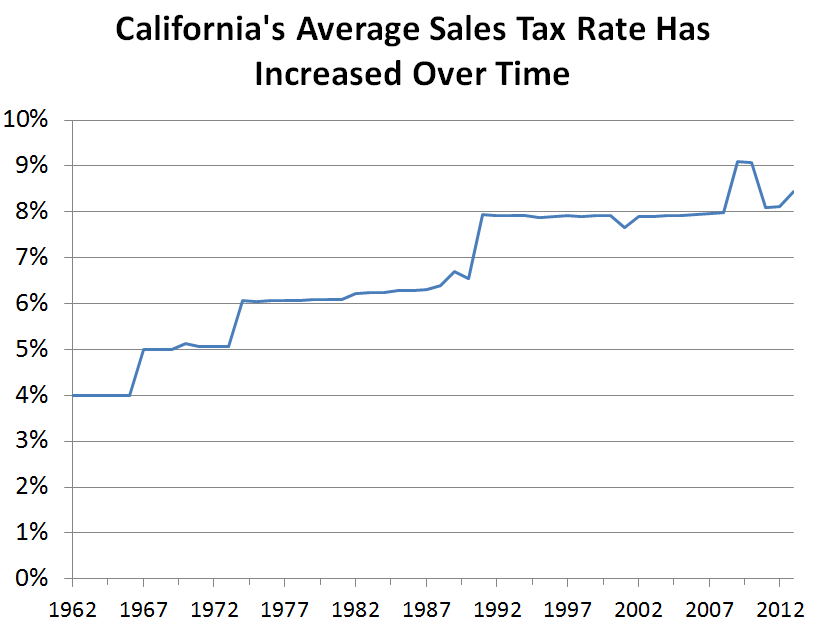

California S Sales Tax Rate Has Grown Over Time Econtax Blog

Unit4 Income And Sales Tax Act

Registration Of Dealer Section 7 Introduction Dealer May Be Any Person Natural Or Artificial Who Carries On The Business Of Buying Selling Supplying Ppt Download

Understanding California S Sales Tax

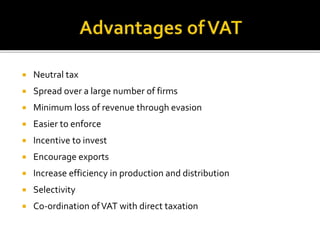

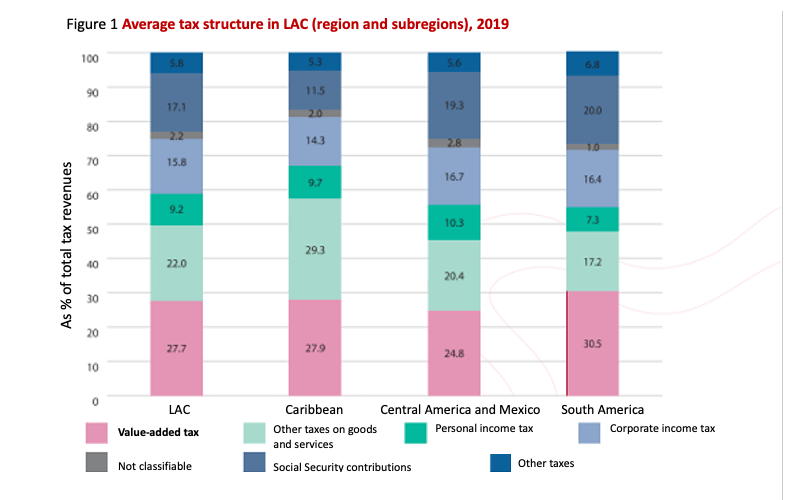

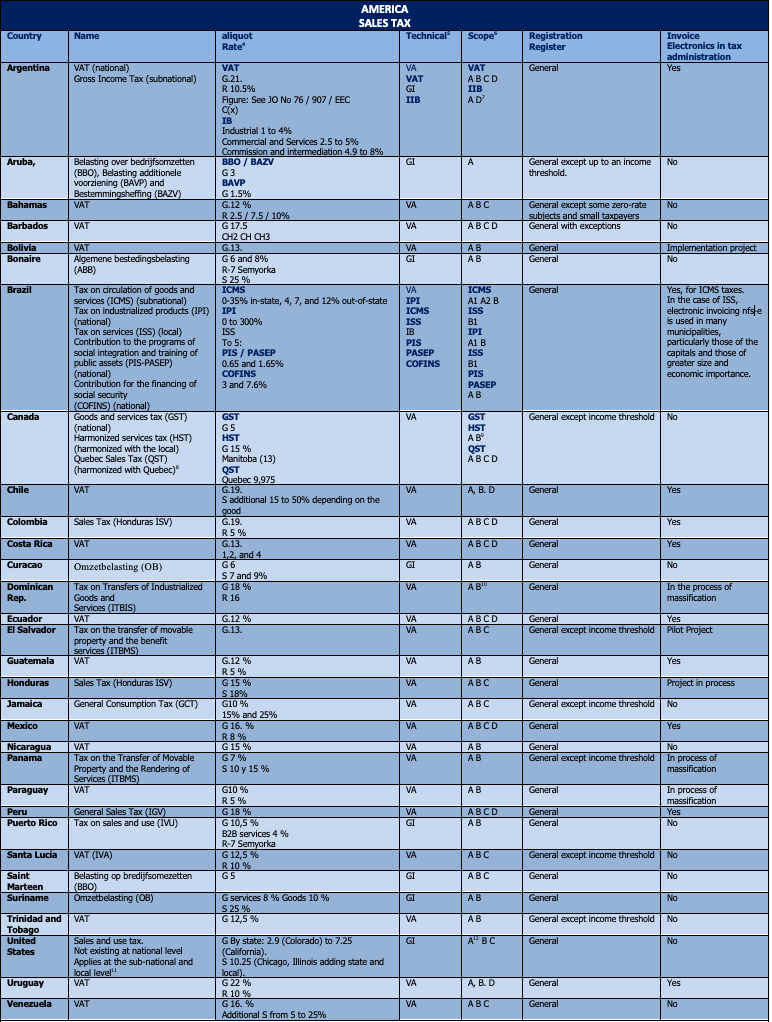

Value Added Tax Its Application In America Inter American Center Of Tax Administrations

Understanding California S Sales Tax

Understanding California S Sales Tax

Value Added Tax Its Application In America Inter American Center Of Tax Administrations

No comments for "sales tax act 1972"

Post a Comment